Wednesday Oct 20, 2021

EP104: The Increasing Atomic Weight of Data

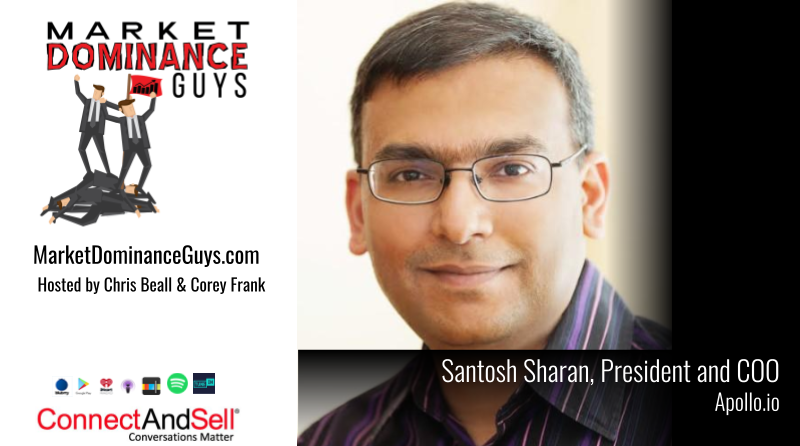

Sales used to be considered a trick done by salespeople, but success in sales today relies more and more on collecting information, analyzing the resulting data, and then using it to finetune your sales department’s approach to prospects. Santosh Sharan, president and COO of Apollo.io joins our Market Dominance Guys, Chris Beall, and Corey Frank, in this first of three conversations about instrumentation that collects data and how careful analysis can help make sense of that data in order to provide guided intelligence to sales teams. Join these three sales-minded experts as they walk you through what to do with all the data you collect in this week’s Market Dominance Guys’ episode, “The Increasing Atomic Weight of Data.”

About Our Guest

Santosh Sharan, president and COO at Apollo.io, a leading data intelligence and sales engagement platform. Previously, Santosh was COO at LeadGenius, COO at Aberdeen, and VP at ZoomInfo.

The full transcript of this episode is here:

Corey Frank (01:14):

Hello. Welcome to another episode of the Market Dominance Guys with Corey Frank and the indomitable, Chris Beall, the Sage of Sales, CEO of ConnectAndSell. Good afternoon, Chris. How are you?

Chris Beall (01:25):

Hey, Corey, I'm doing good, back from Italy and happy to see it.

Corey Frank (01:28):

That's a big back from Italy and really happy, but I'll take that for what it is. But I'm sure you and Ms. Fanucci had many, a wine label that was retired, over the course. That's for the post-show, I think. But we're happy here. We don't want to waste any more time than we have. We're with Santosh Sharan, who is now the President and COO of Apollo.io. And if anybody within the sound of my voice is not subscribed or using Apollo.io and you call yourself a professional salesperson, you're clearly like to operate with one arm behind your back.

But I think what Chris and I are so interested in hearing about today here, Santosh, is your background is certainly you've been a data guy. You're not a carpetbagger. You're not a tourist. This is the industry that you have lived and cut your teeth in for many, many a year, including over at LeadGenius and a little company called Zoominfo. And then of course, I was geeking out before we hit the record button here, but your experience with Aberdeen and Spiceworks.

Since I'm an old IT guy at heart and that community of Spiceworks and Aberdeen that you guys created, we were talking about how really the AISP Community that we have today, the community certainly led by thought leaders, such as Chris Beall and Ryan Treasure and the boroughs of the world, and guys like that. That's what we need in our sales data world today, is what you guys built in Spiceworks.

So if anything, that contribution to, you were saying earlier is that the data comes from content and really, really liked that, Santosh. And maybe we start with that since you're a data guy at heart, but you really build these engaging communities that produce better content, which in turn produces more data. And you have this little flywheel effect that saves.

Santosh Sharan (03:21):

Yeah. Thank you for inviting me. I'm glad to be here with you, Corey and Chris. The way I look at data is, data is a computational representation of reality. So if you allow me to geek out, why do we need data? It's really to simulate real our world problems so computers can run simulations and solve problems. So this computational representation is like an exhaust that comes out of either community or content or multiple other ways that you source data.

But this is also why accurately they're so important. Because if you're simulating something of inaccurate information, then clearly the outcome is going to be inaccurate. And where we stand, even though our discussion will mostly be around the use of data in sales and marketing, but if you think about it, sales and marketing is ahead in some ways using data, but in coming decades and years, you would see use of data in many other.

You already see data being used in recruitment, finance, a few other places. But I think sales and marketing is a very interesting segment to leverage data. Because deals historically, it's all been about human interaction. A good marketer just had a good gut feel 10 years ago, a good CMO. Now, what's happening is like good engineers, we are taking the sales problems or marketing problems or breaking these down into small silos and using data to optimize the silos, whether it's lower in the funnel, top of the funnel or different interactions. And then using automation, we are trying to remove all the inefficiencies.

And one last point that I'll tell for now, sales and marketing contribute to about 30 to 40% of any balance sheet. And there's so much inefficiency because it was not optimized, without data or without automation or without that engineering-type outlook. This is an area of balance sheet that has not been as optimized as operations, finance or some other areas have been. But finally, I think this is one of the frontiers that in the coming decade, or certainly in the last decade you have you seen it getting to.

Corey Frank (05:52):

Why do you think it hasn't been maximized or given the attention that it needs on the balance sheet? You're at ConnectAndSell and you do 5 million. I think your team is responsible for 5 million calls a month come through your pipes, so that's a lot of data. That's a lot of records, more than the average bear, I think is probably the biggest of the bears. But why isn't it had the attention that you think it should have been? What have you seen from churning at a data side, Chris, those 5 million records a month?

Chris Beall (06:23):

I think there've been two reasons. One is that the role of sales in the capitalist economy, when you're factory-bound, when everything is bound by factories producing widgets or producing whatever, has essentially been, I'll put it crudely and I've said it before on the show, to dispose of inventory at sufficient gross profit to keep the lights on. And so the way we've run sales, as we said, sales is a trick done by salespeople. It's almost like if somebody asks a physicist, "What's time?" They say, "Time is what's measured by clocks." So sales is what's done by salespeople and that's it. That's all we knew.

And so what we would do is we say to a salesperson, "Hey, here's your territory. It's your business. And please do go dispose of all of our inventory at whatever prices you can get for it," which is why salespeople who ran territories had discounting authority up to some point because it would affect the margins. But the main thing was, you can't have the output inventory of a factory just pile up forever. You got to get rid of it. You got to get it out into the market.

So that argued for just manage sales like this. Hire a sales rep, put them out in a territory. And if they don't work out, fire them and get another one. And make sure your best territories have your best reps. I think that sums up sales management for about 150 years.

And then something happened. Software came along and got rid of the idea that most of the world's value is represented by factory inventory. So an ever-increasing chunk of the world's economic value is represented by either mind stuff, in the form of software. It doesn't exist until you use it. And then it politely goes away.

So really, there's no inventory to dispose of. Microsoft doesn't have a certain number of units of Windows 11 piling up in their warehouse. So my fiance, Helen Fanucci, who you referred to, she's responsible for making some things happen saleswise. You know how many digits there are in that. I guarantee you, there is a fair number. And yet there's no inventory to move. Now in a way there is. Azure cloud has a certain capacity. But trust me, they're building it as fast as they can. So they're not looking to have somebody sell it out. So that's part of it, as the role has changed.

And now sales has a different role. And the role is to take companies into the marketplace. And ultimately per my thesis, therefore, to bring safety. Companies got a business all the time. The only ones that are safe are the ones that are dominating markets. And so organic growth is our instrument of market dominance now.

Sure we still have M&A going on and all that. But with private equity coming in and pricing stuff up and being so aggressive, it's hard for strategics to play, I'll call it the old M&A game as their only strategy game. You got to be able to go into markets. And the world of startups, of course, is all about go to market. Ultimately you've got to be able to go sell.

The other thing is that it was very hard to get closed-loop information out of sales. Salespersons are out in their territory. Talk to anybody who sells in commercial real estate or runs a commercial real estate company. Ask what the single hardest thing to get a commercial real estate broker to do. It's to put data in the CRM.

Why? Because they're like hairdressers. The idea is if they don't like their working conditions, so to speak, they pull up roots and they go somewhere else. And they take their clients with them. They take their book with them.

Remember back when you used to hire sales reps, it's like, "Hey, comes with a great Rolodex." Those are people they know, or it's people are going to steal. In some industries, it was always people that they are going to steal because they never saw them as not there. So they were there from the get go, and I'm just keeping them. Hairdressers do this all the time. All sorts of people do it.

So without even something as primitive as data in the CRM, which is pretty primitive when you compare it to the flow of data that say comes out of those 5 million conversations a month. I can look right now at one of my customers. I'll look at them. And here they did a little something. We call it flight school. Today, there was a group of, I don't know, about 26 of them had 132 conversations in 1 hour and 22 minutes to set eight meetings on 5,958 dials. And we know their average, wait time was exactly 11 minutes. We know they're dialed to meeting with 744.75 to 1. We know their dial to connect was 45.14 to 1. We know what their conversion rate was to a part of a percentage point. We know how many referrals they got. We know how many follow-ups, blah blah blah blah. But that's what we have now.

More and more instrumentation that allows us to close the loop between what we want to do, what our intentions were and what actually happened.

Chris Beall (11:54):

And without a closed-loop, data's not a reference. It's a representation of reality maybe, or it's just a representation of what somebody thought was going on.

Corey Frank (12:05):

Mm-hmm (affirmative). So to get that, and Santosh, I think you can chime in here, is that where you came from, even before Aberdeen, when you looked at data as a CEO, as a president, Chris, certainly you too, running sales teams for many, many years, how has the atomic weight of data as a sales guy, how has it changed?

And you had mentioned, "If I have a good database, if I'm going through an acquisition, that has real value on my P&L now." Whereas before it was, "I had a Rolodex of clients," but now it's not just about the clients, maybe about my methodology. It's about who picked up the phone versus who did an email and who responds to white paper content regularly, all of that.

So a little bit about what's changed. What have you seen changed in the data world, both you guys, in the respective companies that you've led in the sales teams over the last few years?

Santosh Sharan (13:06):

Yeah. I can take the first step. So a long back, especially for a sales team, data was all about what they saw in the CRM. Just customer records. It started with the Rolodex. Or even before, if you go back, the data was started with the Yellow Pages, where the traveling salesman, whoever digitize that Yellow Page spun off the data industry in some way.

So that evolution has continued and continues to get complex. But you used a very interesting word, atomic weight of data. I like that. Initially it was only CRM, but fast forward there is so much data around that CRM data, that has increased that atomic rating in some way. Data on demand, on timing, on past behavior. What tools have they bought in the past? What is the intent to buy in the future? And are they exhibiting certain traits? Are they hiring for certain roles that will make them good candidates to buy a sales tool? Has there been any recent Exec change? Have they raised around the financing?

So all these other pieces of information that we correlate that makes, I guess the job of the sales rep, you can say a little easier. I shouldn't say it's easier. It provides some guided intelligence.

Corey Frank (14:37):

I think that word guided intelligence, Chris, you and I have spoken about it. I think we had a couple of guests on at one time or another on our well over 100 episodes now. I think we're cracked into three digits of the number of episodes, where we talked about the mythology that certain reps have for data.

If you remember Harvey Mackay had the MACKAY 66. I think it was dig your well before you're thirsty were his guidance for his... He sold envelopes. You remember when we're with Harvey? Swim with the sharks before you're eaten alive. He lives out here in Phoenix. And great best-selling author. And the MACKAY 66 was about, "Can I get 66 pieces of information on every one of my prospects or clients?" Not at once, but over my relationship, their birthday, their spouse's name, they'd like to golf or tennis, which their favorite bourbon. And as I amass this data, I like the term he used, boss behavior. That's a good one.

Because I may have a great prospect. But if I'm working inside an organization that has a sense where it's a not invented here shop. Or it's a very methodical buying shop. All these mythologies exists that I may give a lead to Corey Frank, here you go, this is a good lead. He's a CEO of a large SaaS company. His name is Chris Beall. And his fiance is Helen Fanucci. And he has this much of experience. He's good at math. Great.

What else can I get about him? What do you see in terms of that? Because it's becoming more and more rich. And where is this tipping point? And what are the factors that I care a little bit more about than others when I'm a sales rep collecting this data or a sales manager, trying to collect data? Chris, I bet you have a distinctly different perspective on this than Santosh, for sure.

Chris Beall (16:25):

What does that mean? I have to go first.

Corey Frank (16:29):

This is the part where we have a little tension. We throw it in there because especially germane with what ConnectAndSell does versus setting up all this other data, I think it would be interesting to talk about that.

Chris Beall (16:43):

It's interesting because Santosh, I think you're right in some ways. The job has gotten easier. But the fun thing about sales is how easy or hard the job is, it always turns out to be irrelevant. It's only what you can do competitively that counts. Sales does that one part of business where competition not internal, but external competition, ultimately rules.

I think it's one of the reasons sales leaders don't last very long. It's because nobody knows how to be competitive in a predictable way. They're trying to predict everything about the market, but they can't predict whether they will actually win the competition with whoever it is that's out there, that they're fighting with. If they can figure out even who that is. And if they can do it before they get canned or run out of money or whatever crazy thing happens. So it's kind of funny.

I make the distinction between three categories of data. There's publicly available data that anybody can get without doing anything. Google is providing us huge amounts of that. When somebody says that, "I'm going to meet with the guy tomorrow. And he's a CEO of a company that I don't really know very much about. And all I did was just went out and Googled him. And in less than five minutes, I knew many, many more than 66 things about him. Many, many, many more." And guess what? So with anybody else who's meeting.

So I would put that in the domain of publicly available data that might take a little skill, not much. I will put for public companies, their last quarterly earnings or the transcript of that call contains an amazing amount of valuable information about that company's intentions. If the CEO mentions a product that they're actually taking to market in the first three paragraphs, he's panicked. That's just as simple as that. CEOs don't like to talk about being saved by-products. Because that sounds really, really bad. But if they acquired a company and they think that they've got to do something in the market, they'll throw that bone to these analysts and mention a product. Okay, well that tells you something about their company.

Still publicly available. It takes a little bit more business acumen to process it and turn it into something of value. And there's only so much of it you can process per unit time. You're only so good at whatever you do.

Then there's the world of I'll call it private data. Private data comes out of conversations, is completely proprietary. Tomorrow when I have this conversation with the CEO in question, I will learn things as well he, that no one else on earth knows. And some of it will be emotional stuff. It'll be subtleties in the conversation. It'll be what lights him up. What does he hesitate on? Some of it will just be things he's likely to tell me that he wouldn't publish to the world.

And then in between, there is not publicly available data per se. You can't Google it up, but it's acquirable data. And there's market made in that data. Santosh's company is a brilliant example of making market in that data. And in more than that, because they also make market functionality around the data. Like, what do you want to do with them? Do you want to call them? Do you want to send them an email? You can act on the data.

So it's where pay for the combo privilege, I'd call it, of knowing more than the other guy and speeding up and being more precise in your actions. And that's the deadly combination that if you combine it with private data, proprietary data allows you to take a dominant position in the marketplace because you see more than anybody else and you can react to it.

So I make those three distinctions. One of them grows a little bit every day, publicly available data. One of them only grows when you have conversations, that's our business, taking folks from two conversations to 50 or whatever. So if they're good, they have 25 times as much privately available data, they'd have proprietary data.

And Santosh's business, I think, and you can correct me if you're wrong, is to make the data that is kind of publicly available, make it make sense to you and your organization. So you can use it to guide action and become both more efficient and more effective with the resources you have to hand today, which are your sales reps and your products pretty much. That's kind of my view.

Santosh Sharan (20:49):

I love the way you described, Chris, this publicly available data. And then data that an expert can acquire. And then private data. I'll just continue with your classification.

I think what we do or a lot of data companies do is 10 years ago, an expert sales rep or a manager, what they could do with lots of training and intuition now with data and automation, somebody right out of college can do that. Or the outcome could be as efficient. And it's not just using Apollo, but also using ConnectAndSell. And there are many other tools, not just the two of us.

So if I bring in another element to this discussion, which I find interesting, when I think about what's giving rise to so much of data, I think it's inherently, the value of human attention has gone up. We are all continuously distracted with 10 other things. Even in every category, they used to be one or two companies dominating that category. Now there are 40 companies. So even buyers have problems dealing with which one of these 40 should I go with?

So salespeople have to deal with this cost of buyer attention or human attention in general. How do they deal with it to increase personalization? And they have to do this at scale. And this is where I think automation and data comes in.

And I'll just say one more thing. So with all this data and intelligence and automation, it doesn't make the sales reps redundant in the job. If anything, it pushes the rep to just focus on what they should have focused on right from the beginning, which is to build that trust and credibility.

And this is where Chris's company comes in with the calling, with that human voice, provides the trust and credibility. But all they should be doing is providing education to the buyers. Instead, where sales reps spend time is 80 to 90% on everything else. And hopefully with technology and automation, they won't have to do that. That's almost the redundant job that should be outsourced to some machine.

Corey Frank (23:14):

I'm curious as a sales guy, when I look at just number of fields. And you have these inflection, these power up levels, when you look at old Harte Hanks info USA data, that I think the three of us probably called through the old mechanism probably similar to this, that old rotary phone.

When you look at data like that, Santosh, what have you seen as the different inflection points over the years, especially coming from LeadGenius and Spiceworks? Again, maybe to come back to content. Or is it certain added fields? Cell numbers was a big inflection point when you could get cell numbers attached to data was a big thing, five, seven years ago. Now, what do you think it is?

Santosh Sharan (23:59):

Let me take you back 40 years. But that's a really good question. I love historical perspective because when you look at things from long term, everything in life is just the same pattern being repeated, again and again.

If you go back into time, like 1960s, 70s when the telephone directory was digitized in CD-ROM. So there was a lot of data. So we go through this phase where there's expansion of data. And then people don't know what to deal with so much data.

First, they want data because there's none. Then there's too much data. Then there is new technology to make that data meaningful by contracting. And then there's too little data because human evolution catches up. And then there's expansion. So let me just walk you through three or four of these pivot points that you talk about.

So when there was too much data from phone directories, somebody got the brilliant idea of compiling this phone directory by prosperous zip codes. And for a while, that worked really well. And then everybody had a phone, so there was way too much phone directories eventually. So the CD-ROM thing didn't work very well.

So this is when Harte Hank started their market intelligence data or the call centers. And this is still 40 years ago. So they had thousands of people, if not tens of thousands. In fact, Aberdeen was a spinoff from Harte Hanks, so a lot of them. Now, you manage to contract data because of [inaudible 00:25:33]. Now you could say, "I don't just want only VP marketing. I want the VP marketing that has bought a Xerox printer in the past. Or that is willing to invest in a Unisys mini-computer worth millions of dollars."

Then the internet came in the 90s. So then it made sense. So Jonathan, who was the founder of Zoominfo got that brilliant idea of scraping the internet to compile the same data. Now again, we started a new pivot point. Because now again, the data became too much. So you started compiling then there were tens of millions of contacts.

So compare that to the full directories that became millions and Harte Hanks call-center kind of created sanity and that's why Harte Hanks had a multi-billion dollar valuation. So now you had so much of data being compiled to internet. In the beginning, it was great. You could go in such in these tools and get, you know? But then there's too much data.

So not surprisingly, you see companies like EG DATA, [inaudible 00:26:41] or Bombora or [inaudible 00:26:44]. These initiatives are helping call... They are like filters. So you don't have to look for only VP market. You can look for it by certain criteria. And Apollo builds some of that as well. But this will continue all the time. Because it's like our pursuit of knowledge. It never stops. So pursuit for data we'll always have more and more advanced features by which we will find... And I think it'll become more niched and more vertical oriented. I think we are exhausting the horizontal approach.

Now there might be specific filters for legal industry or real estate like Chris was talking about. So the same data, but then think about Zoominfo or Apollo is going to have only so many filter that applies to everybody. Then if there's an conductor of Apollo or Zoominfo only for real estate, then we can have filters like, is it a commercial real estate? Is it residential? Is it a multi-family home? Or single family? Things that we don't provide.

So I think those are some of the data elements that will be, I guess, discovered in the future. In the meantime, the overall size of data as people log onto the internet and use more. So remember, if we feel like the internet is saturated because we live in the US. But globally, there's still about half the world yet to join the internet, which means the size of these databases will just continue to rise and explore.

Corey Frank (28:24):

Mm-hmm (affirmative). You just gave the mother of all excuses to any sales reps who's listening to why I miss my numbers because only there's so much of the world that still isn't on the internet and I can't get to them. My territory is a little too small. That's what I heard as a sales guy. It's insane.

No comments yet. Be the first to say something!