Episodes

Tuesday Aug 15, 2023

EP192: Sales Insights Using Sailing Strategies for Business Success

Tuesday Aug 15, 2023

Tuesday Aug 15, 2023

Today's adventure is a jaunt on the high seas with Chris Beall's wife, Helen Fanucci, the sailing extraordinaire (before she even became his better half).

Now, my sailing skills are on par with a landlocked pirate. But no matter because this story isn't just about boats and briny waters – it's a tale of drive, insight, and a dash of brilliance that'll leave you pondering your business compass.

Picture it: a sun-soaked day, a boat called J80, and Helen Fanucci – a mechanical maestro with a thirst for precision. Amidst the waves, she spots a teeny metal tab on the mast, having a bit of a tiff with its groove.

But here's the twist – she didn't pounce on the problem like a hungry seagull on a French fry. Oh no! She executed a strategic dance of action and contemplation. Think of it as a chess grandmaster swapping their knight for a piña colada mid-game. The result? A symphony of decisions, a triumphant "click," and a lesson that'll rock your business boat. Join Chris for the full story in this episode, "Sales Insights Using Sailing Strategies for Business Success."

Full episode transcript below:

Wednesday Aug 09, 2023

EP191: Boosting Your Sales Swagger with AI As Your Backup Dancer

Wednesday Aug 09, 2023

Wednesday Aug 09, 2023

In this episode, we step in with the AI sales tango. Corey, our tree-hugging sales champ, questions if AI can replace good old empathy. Our resident sales physicist, Chris chimes in, revealing AI as your trusty confidant, not a sales rival.

Chris dishes out AI secrets: it's an emotional prosthetic, erasing self-doubt and boosting confidence. It's like AI saying, "You've got this!" Corey and Chris tag-team AI's power in sales—providing insights, suggesting next moves, and extinguishing self-doubt. AI's not stealing the spotlight; it's your backup dancer, complementing your sales swagger.

They salsa through the AI-human tango, admitting AI won't replace human connection magic. But it's the GPS guiding you through the sales maze. The bottom line? Episode 191 busts the myth: AI isn't your enemy; it's your trusty sidekick on the sales stage. Join us for this episode, “Boosting Your Sales Swagger with AI As Your Backup Dancer."

Linked from this episode:

Corey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Full episode transcript below:

Wednesday Aug 02, 2023

EP190: AI for Sales? Don’t Be Candy Crush Complacent!

Wednesday Aug 02, 2023

Wednesday Aug 02, 2023

Are you looking to gain a competitive edge in your sales process? Are you interested in understanding what lies deep inside your sales funnel and pipeline to drive more revenue? Then you don't want to miss this episode!

Join our Market Dominanc Guys, Chris Beall, and Corey Frank, as they dive deep into the world of sales technology and AI-powered tools. Discover the true advantage of understanding and optimizing the flow rate within your sales projects. Learn why it's essential to focus on time as the denominator when measuring success rather than vanity metrics like conversion rates.

They provide valuable insights on discerning whether a tool truly de-risks your sales path and reduces friction or merely adds to your tech stack inventory without tangible results. Explore the fascinating concept of "speed beats free" and why pushing time on the denominator matters more than dream outcomes in sales.

Join us for this episode, “AI for Sales? Don’t be ‘Candy Crush’ Complacent

Thursday Jul 27, 2023

EP189: Rock Salt & Roll: Unraveling Sales Tech’s Mystery

Thursday Jul 27, 2023

Thursday Jul 27, 2023

Chris Beall and Corey Frank take us on a nostalgic journey through the evolution of sales tech and the intriguing world of AI. They start with a blast from the past, reminiscing about a 1960s AI program called Eliza, which acted as a non-directive therapist, fooling people into thinking it was a friend. Fast forward to the present day, they question the true value of CRM systems, pondering whether they actually help make money or just keep salespeople organized.

Corey shares a road trip story of stumbling upon racks of rock salt in Alabama, sparking the idea of the right people selling the right tools. Chris passionately emphasizes that onboarding salespeople should involve engaging them in discovery meetings from day one to boost their success.

This episode encourages sales managers and CEOs to rethink their sales tech strategies, focus on revenue-generating activities, and find the perfect balance between the human touch and AI. Join us for “Rock Salt & Roll: Unraveling Sales Tech's Mystery.”

Linked from this episode:

EP9: How to Harvest Authentic Trust in your Discovery Calls

Corey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Wednesday Jul 19, 2023

EP188: Bottlenecks Beware: Flow Rates Coming to Crash the Party!

Wednesday Jul 19, 2023

Wednesday Jul 19, 2023

Chris unravels the enchanting world of manufacturing. Gone are the days of painstakingly crafting artifacts one by one, like our Stone Age ancestors. Now, we're immersed in the art of flow manufacturing, where tanks channel the flow of chemicals, and even discreet manufacturing dances to the rhythm of flow. It's a symphony of efficiency where our sales teams manufacture opportunities, creating the invaluable currency of option value.

Chris urges us to view our sales organizations as factories where identifying bottlenecks and maximizing flow rates are the keys to success. In this world, conversion rates become the icing on the cake, but only after we've mastered the flow.

Finally, Chris challenges the age-old debate of quality versus quantity and reminds us that we're left with nothing without quantity. Join us for this episode, "Bottlenecks Beware: Flow Rates Coming to Crash the Party!"

Links from this episode:

Corey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Full episode transcript below:

Thursday Jul 13, 2023

EP187: Prospecting Costs - Dollars Spent, Dollars Missed

Thursday Jul 13, 2023

Thursday Jul 13, 2023

The game isn't won with the buzzer shot. The game is won by endless hours of preparing for the buzzer shot. Chris and Susan dive deep into the often-overlooked topic of prospecting costs and return on investment (ROI). Chris's passion for the subject shines through as he challenges conventional thinking and emphasizes the importance of time as the ultimate business denominator. He reveals that traditional efficiency metrics like conversion rates and ratios have little to do with business success. Instead, he argues that prospecting is about maximizing the value of every hour and building a robust pipeline. Chris expertly breaks down prospecting ROI, highlighting the investment in time and the need to attribute pipeline growth back to conversations.

Throughout the episode, they share pro tips and emphasize the need for a strategic and holistic approach to prospecting beyond research and follow-ups. This engaging discussion is a must-listen for sales professionals looking to unlock the true potential of prospecting and boost their ROI. Join Chris and Susan for this episode, "Prospecting Costs and ROI: Dollars Spent, Dollars Missed."

Links from this episode:

Susan Finch on LinkedInChris Beall on LinkedIn

Funnel Media GroupConnectAndSell

Full episode transcript below:

Thursday Jul 06, 2023

EP186: Hot Dogs and Hot Deals - Devouring Sales Records

Thursday Jul 06, 2023

Thursday Jul 06, 2023

Chris and Corey asked me to prepare you for a mind-expanding journey as we take Dr. Goldratt’s theory of constraints beyond its traditional boundaries and revolutionize the way you approach sales. Discover the art of identifying the true constraint and learn why pulling together as a team can sometimes snap the traces. We uncover the secrets of critical paths, buffers, and the profound impact of time in the fast-paced sales arena. Embrace your inner rebel and challenge the norms by seeking fresh perspectives from other disciplines.

But wait, there's more! Get inspired by the legendary story of competitive eater Kobe and his unconventional strategies that shattered records. We'll show you how to think outside the bun and achieve unprecedented sales success. Join us for this episode covering mastering sales success by unleashing the power of constraints and revolutionary strategies but we’ll just call it, “Hot Dogs and Hot Deals: Devouring Sales Records!"

Links from this episode:

Corey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Full episode transcript below:

Tuesday Jun 27, 2023

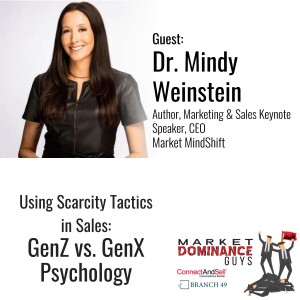

EP185: Using Scarcity Tactics in Sales - GenX vs GenZ Psychology

Tuesday Jun 27, 2023

Tuesday Jun 27, 2023

Chris and Corey continue their conversation with Dr. Mindy Weinstein, as they delve deep into the psychology behind scarcity and its profound impact on consumer behavior. You'll uncover invaluable insights on how scarcity appeals to different generations, especially the younger demographic, and how you can leverage this powerful phenomenon to drive sales success. Drawing from their wealth of experience, Corey and Chris share practical strategies on positioning salespeople as indispensable resources in a scarce market, fostering authentic connections, and building trust through genuine expertise. By the end of this episode, you'll be equipped with actionable tips and powerful communication techniques to elevate your sales game and unleash your full potential. Don't miss out on this opportunity to transform your sales approach—tune in now and unlock the untapped potential of scarcity! Join us for this episode, "Using Scarcity Tactics in Sales: GenX vs. GenZ Psychology."

Links from this episode:

Dr. Mindy Weinstein on LinkedInCorey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Full episode transcript below:

Wednesday Jun 21, 2023

EP184: Cracking the Code; Scarcity Strategies for Sales Success

Wednesday Jun 21, 2023

Wednesday Jun 21, 2023

In this episode Chris and Corey are joined by the brilliant Dr. Mindy Weinstein, marketing expert and author of the bestselling book, "The Power of Scarcity." If you want to boost your sales game, this episode is a must-listen. Dr. Weinstein breaks down the secrets behind scarcity and its four types: time-related, demand-related, supply-related, and limited edition scarcity. Learn how to tap into the psychology of scarcity and motivate your customers to take action. Together, they explore the dynamics of scarcity in business and the impact it has on sales and marketing strategies. They also emphasize the importance of trust and credibility. Don't be that professional who abuses scarcity—build genuine relationships first! Join the Market Dominance Guys for a an insightful exploration of the power of scarcity in sales, in "Cracking the Code: Scarcity Strategies for Sales Success."

About Dr. Mindy Weinstein

Marketing is her passion. Over the last several years, she has trained 15,000+ people how to effectively approach marketing and sales in today's climate. Through webinars, workshops and conferences, her goal is to educate the business world one person at a time. As part of this goal, she has been researching, teaching and consulting about marketing psychology, with a special focus on the power of scarcity. In fact, that’s the name of her bestselling book, The Power of Scarcity: Leveraging Urgency and Demand to Influence Customer Decisions (McGraw Hill 2022).

Links from this episode:

Dr. Mindy Weinstein on LinkedInCorey Frank on LinkedInChris Beall on LinkedIn

Branch 49ConnectAndSell

Full episode transcript below:

Tuesday Jun 13, 2023

EP183: Sales Mastery - Body Language and AI Giving You the Edge

Tuesday Jun 13, 2023

Tuesday Jun 13, 2023

Chris and Corey continue their conversation with Ben Sternsmith of Sybill AI . This episode covers how AI is revolutionizing the sales process, making it more precise and empowering for sales professionals.

Discover how AI analyzes tonality and body language, equipping salespeople with unparalleled accuracy in assessing deal progress. They discuss the importance of building trust with clients and how AI can support but never replace the human touch in establishing meaningful connections.

They also explore the resurgence of cold calling as a powerful strategy in the digital age and introduce Dealy. This innovative AI-driven solution enhances CRM systems by analyzing customer interactions and providing valuable insights.

Join us for this insightful episode that explores the synergy between sales and AI, offering practical tips and inspiring ideas for sales professionals.

Links from this episode:

Ben Sternsmith on LinkedInCorey Frank on LinkedInChris Beall on LinkedInSybill AIBranch 49ConnectAndSell

About Sybill AI

Sybill AI is an AI company that originated as a Stanford project three years ago. The founders, frustrated with the limitations of remote teaching, developed a behavioral AI engine over Zoom. This innovative tool records calls and analyzes body language to determine engagement levels. Leveraging the power of large language models like GPT-4, Sybill AI offers generative AI for salespeople. It automatically generates call summaries, writes AI-powered follow-up emails, and even appends CRM data.

Full episode transcript below:

We are in the midst of an exciting yet seismic change across the profession of modern sales. Improved (and much smarter) marketing tools, more compelling sales methodologies, better-designed datasets, and even the introduction of Artificial Intelligence have all lent a hand to upgraded efficiency and higher close rates. The unshakable mission of a company, however, remains constant - if not all the more elusive: "Those that dominate their market are those that are going to win." Join Chris Beall and Corey Frank for a journey into the vast forces, best practices, and simple path that can propel your organization to reach true market dominance.

Chris Beall - Your Co-host

Chris has been participating in software start-ups as a founder or at a very early stage for most of the past 35 years. His focus has consistently been on creating and taking to market simple products that can be used successfully the first time they are touched, without taking a course or reading a manual. His belief is that the most powerful part of any software system is the human being that we inappropriately call a “user”, and that the value key in software is to let the computer do what it does well (go fast without getting bored) in order to free up human potential.

Corey Frank - Your Co-host

Corey Frank is – at heart – an idea guy, as well as a sales guy, who can take a good punch…repeatedly. He loves launching relevant technology, shepherding culture-rich and sales-driven organizations and cultivating teams to spark serious revenue.

From founding and helping early-stage technology companies from the kitchen table phase to helping bring them all the way to IPO or strategic acquisitions totaling over $625MM, he’s also helped pitch and raise over $200MM in venture and Reg A capital. He is a Partner and Pitch Coach with multiple #1 best-selling sales author Oren Klaff (Orenklaff.com) at PitchAnything.com.